How to Choose the Right Payment Gateway for Your E-Commerce Site

1. Introduction

As the digital revolution continues to take over every corner of the globe, e-commerce is the new normal. But behind every successful online store is a complex web of decisions that entrepreneurs have to make – decisions like which payment gateway to use. If you’re in the process of building an e-commerce website or seeking to enhance an existing one, understanding how to choose the right payment gateway is key.

But why is a payment gateway so important? Picture this. A customer fills up their online shopping cart with your goods, makes it all the way to checkout, and then… their preferred payment method isn’t available. Frustrated, they leave, and you’ve just lost a sale.

Picking the right payment gateway is about much more than making sure customers can pay. It affects user experience, conversion rates, and even your bottom line. That’s why we’re tackling this topic today.

In this blog post, we’re going to delve into:

- The definition and Role of a payment gateway in e-commerce

- Factors to consider when choosing a payment gateway

- The pros and cons of popular payment gateways

- How to integrate your chosen payment gateway into your e-commerce site

Our goal is to give you a practical understanding of payment gateways, providing clear and concise insights that will help you make an informed decision for your e-commerce business. So, let’s dive in and demystify payment gateways together.

2. Understanding E-Commerce and Its Payment Systems

Before we delve into the nitty-gritty of choosing the right payment gateway for your online business, let’s establish a shared understanding of e-commerce and its integral payment systems.

What is E-Commerce?

Electronic commerce, more commonly known as e-commerce, is the buying and selling of goods and services on the Internet. From buying books on Amazon to ordering food delivery via Uber Eats, e-commerce is an integral part of our daily lives. It’s not just important; it’s fundamental to the modern economy.

The main advantage of e-commerce lies in its convenience and accessibility. As long as you have an internet connection, you can shop from anywhere, at any time. This means e-commerce opens up a global market for businesses, providing opportunities to reach customers they could never reach with a brick-and-mortar store.

According to Statista, global e-commerce sales are projected to reach $6.54 trillion by 2023, underscoring the importance of understanding e-commerce payment systems.

E-Commerce Payment Systems: An Overview

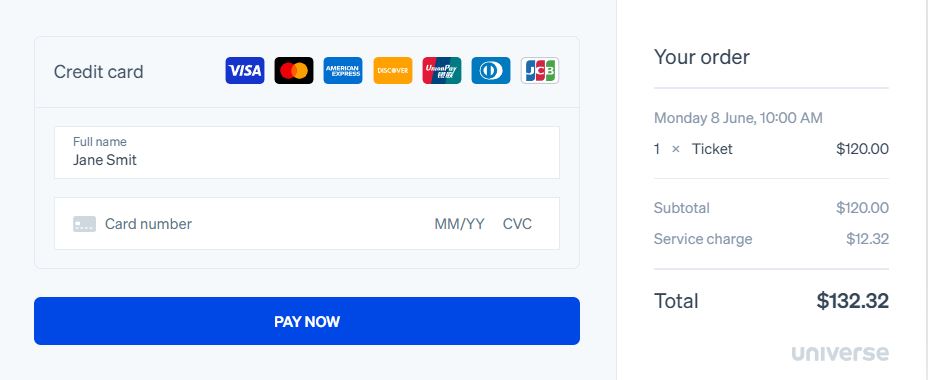

At the heart of every e-commerce transaction is a payment system. This system consists of the methods and processes that allow customers to pay for their purchases online. There are several types of online payment methods, such as credit cards, debit cards, digital wallets (like PayPal and Apple Pay), and bank transfers.

3. What is a Payment Gateway?

Let’s think of e-commerce as an online party. At this party, a payment gateway plays the role of an all-important bouncer. It checks the credentials of every transaction (guest) and decides whether to let it in (process) or turn it away (decline).

In more formal terms, a payment gateway is a technology used by e-commerce sites to process credit card payments and other forms of electronic payments. It’s a secure avenue through which payments are made on an e-commerce platform. A reliable payment gateway is crucial because it ensures that all transactions are completed securely and promptly, adding a level of trust to your online store.

In 2020, digital payments accounted for 72% of all transactions worldwide, making a payment gateway a vital component of any e-commerce business.

How Do Payment Gateways Work?

Let’s break down how payment gateways work, keeping it as simple as possible. When a customer clicks ‘buy’ on your site, here’s what happens:

- Data Encryption: As soon as the customer inputs their payment details and hits the ‘buy’ button, the payment gateway encrypts this information. This encryption ensures that sensitive information, such as credit card numbers, is safe and secure.

- Transaction Forwarding: The encrypted information is then sent to the customer’s bank for approval. The bank will confirm if the transaction is legitimate and if there are sufficient funds in the customer’s account.

- Transaction Verification: The bank sends back a response – either approval or denial – to the payment gateway.

- Completing the Transaction: If approved, the transaction is processed, and the customer’s account is debited. If denied, the customer is informed, and the transaction is halted. Either way, the payment gateway sends a message back to your website to finalize the process.

- Funds Transfer: The bank transfers the funds to your (the merchant’s) account. This process may take a couple of days.

In essence, a payment gateway is a messenger that shuttles money and information back and forth between your website and your customers’ banks. This all happens behind the scenes, in real-time, and often in less than a few seconds. In our next section, we’ll explore the key factors to consider when choosing a payment gateway for your e-commerce site. Stay tuned!

4. Why the Right Payment Gateway Matters

Choosing the right payment gateway might seem like a minor detail in the grand scheme of your e-commerce plans, but it’s far from insignificant. Let’s break down why.

A. Impact on User Experience:

In the world of e-commerce, user experience is king. Your payment gateway is a pivotal part of this user interface. Here’s why:

- A well-designed user interface could increase your website’s conversion rate by up to 200%, according to Forrester Research.

- A smooth, simple, and versatile payment gateway can make the checkout process a breeze, increasing the likelihood of returning customers.

- On the other hand, a difficult-to-use payment gateway that doesn’t offer preferred payment methods could lead to customer frustration and potential loss.

B. Effect on Conversion Rates and Sales:

Your payment gateway can have a direct impact on your conversion rates. Consider the following:

- A study by Baymard Institute found that nearly 70% of online shopping carts are abandoned due to payment issues.

- By choosing a reliable and user-friendly payment gateway, you can decrease cart abandonment and boost your sales.

C. Importance for Business Growth and Scalability:

As your business grows, so too will your payment processing needs. A good payment gateway will scale your business.

- Your gateway should provide features that cater to your growing needs, like support for multiple currencies or integration with different shopping carts.

- As your sales volume increases, you’ll need a payment gateway that can handle the extra load and offers robust security features.

In short, the right payment gateway isn’t just a tool for accepting payments. It can enhance your customers’ experience, boost your sales, and support your business growth. In the next section, we’ll delve into the key factors to consider when choosing a payment gateway, to ensure you make the best choice for your e-commerce business.

5. Factors to Consider When Choosing a Payment Gateway

Now that we understand the crucial role of a payment gateway in an e-commerce business, let’s dive into the nitty-gritty. How do you choose the right one for your site? Here are key factors you should consider:

A. Security Features and Compliance Standards:

The safety of your customers’ sensitive data should be paramount. Look for a payment gateway that offers advanced security features like encryption and tokenization, and is PCI-DSS compliant.

- Encryption ensures that the transaction information is unreadable to anyone except the payment processor.

- Tokenization replaces sensitive data with unique identification symbols retaining all the essential information without compromising its security.

- PCI-DSS Compliance (Payment Card Industry Data Security Standard) is a security standard that ensures that all companies accept, process, store, or transmit credit card information and maintain a secure environment.

B. Costs and Fees Structure:

Payment gateways come with a variety of fee structures. Common fees include transaction fees, monthly fees, setup fees, and chargeback fees. Make sure you understand all the costs involved and that they fit into your business model.

C. Integration with Your E-commerce Platform:

Ensure the payment gateway you choose can be easily integrated into your existing e-commerce platform. If it’s complicated to implement or not compatible with your site, it could cause unnecessary headaches.

D. Customer Experience Considerations:

A complex or confusing payment process can lead to shopping cart abandonment. Look for a payment gateway that offers a simple, streamlined checkout experience. Features like a mobile-friendly interface and one-click checkout can significantly enhance customer experience.

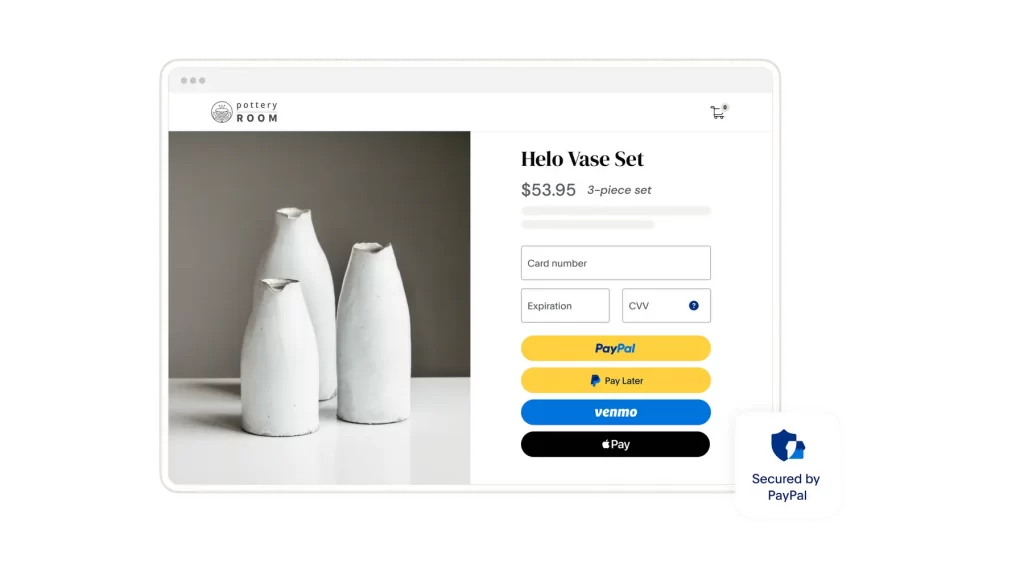

E. Supported Payment Methods:

Different customers prefer different payment methods, including credit and debit cards, digital wallets, and bank transfers. Your chosen payment gateway should support a broad range of payment methods to accommodate all your customers’ preferences.

F. Global and Local Payment Processing:

If you plan to sell internationally, you’ll need a payment gateway that supports multiple currencies and international payment methods. However, don’t neglect local preferences. Some regions prefer specific local payment methods, and supporting these can increase your conversions.

G. Quality of Customer Support:

Reliable customer support is critical in case something goes wrong. Look for a payment gateway provider that offers prompt and efficient customer service, preferably 24/7.

H. Future Growth Compatibility:

Finally, consider your business’s future. As your e-commerce store grows, you’ll need a payment gateway that can scale with you. Look for providers that offer additional features or higher service tiers that you can move to as your business grows.

Studies reveal that 58% of consumers prioritize security when making online payments, making robust security features a crucial factor to consider when selecting a payment gateway.

Choosing the right payment gateway might take some time, but the investment will pay off in the long run. Your payment gateway is not just a tool for transactions; it’s an integral part of your customer’s experience and your business’s success. So choose wisely!

6. A Comprehensive Comparison of Popular Payment Gateways

Let’s dive right into it. We’ve rounded up some of the most popular payment gateways – PayPal, Stripe, Square, Authorize.Net, and Braintree – to give you a side-by-side comparison. Remember, the best choice will depend on your specific needs and circumstances.

I. PayPal:

- Pricing: PayPal‘s standard rate is 2.9% + $0.30 per transaction. There are no setup or monthly fees, but there may be additional costs for services like advanced fraud protection and recurring billing.

- Features: PayPal is recognized globally, supports a wide range of currencies, and offers seamless checkout experiences. Plus, PayPal’s name recognition can lend credibility to your business.

- Pros: Easy to set up and use, globally recognized, supports recurring billing.

- Cons: The transaction fee can be higher compared to others, and customer service might not be as prompt.

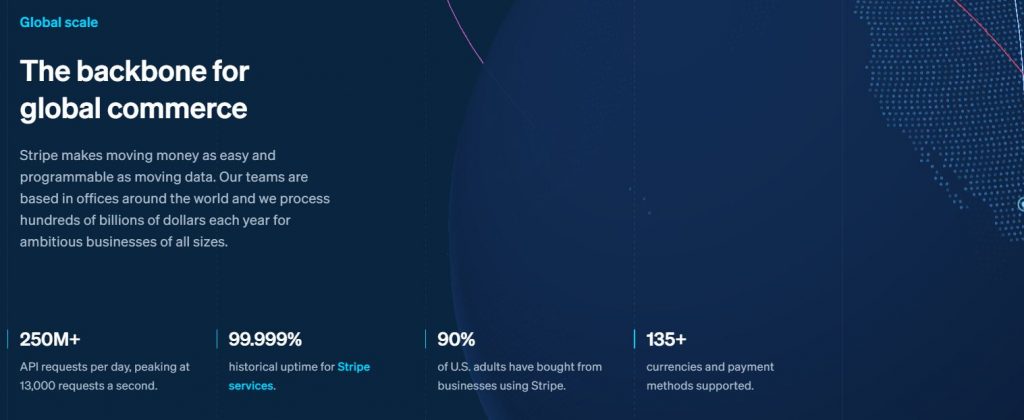

II. Stripe:

- Pricing: Stripe charges 2.9% + $0.30 per transaction, similar to PayPal. There are no setup or monthly fees, but additional services may carry extra charges.

- Features: Stripe stands out for its customization capabilities. If you have development resources, you can create a unique payment experience. It supports over 135 currencies and various payment methods.

- Pros: Highly customizable, and supports a wide range of currencies and payment methods.

- Cons: Requires some technical knowledge to take full advantage of its features.

Stripe processed over $400 billion in transactions in 2020, solidifying its position as one of the leading payment gateways in the market.

III. Square:

- Pricing: Square charges a flat rate of 2.6% + $0.10 per transaction for swiped, dipped, or tapped payments from a Square Reader or Stand. For manually entered transactions, the fee is 3.5% + $0.15.

- Features: Beyond its payment gateway, Square offers a suite of business tools like appointment scheduling, inventory management, and sales reports.

- Pros: Offers a comprehensive business solution, and competitive rates for swipe and chip transactions.

- Cons: Higher fees for manual transactions, not as versatile for international businesses.

IV. Authorize.Net:

- Pricing: Authorize.Net charges a monthly gateway fee of $25, plus 2.9% + $0.30 per transaction.

- Features: Authorize.Net is known for its advanced fraud detection features and its ability to set up recurring billing.

- Pros: Excellent security and fraud prevention features, supports recurring billing.

- Cons: Monthly fees and setup costs can be a barrier for smaller businesses.

V. Braintree:

- Pricing: Braintree, a service provided by PayPal, charges the same rate of 2.9% + $0.30 per transaction with no setup or monthly fees.

- Features: Braintree supports a large number of payment methods, including popular digital wallets, and offers robust fraud protection.

- Pros: Wide range of supported payment methods, strong fraud protection.

- Cons: Like Stripe, it requires some technical knowledge to integrate and customize.

This comparison should give you a head start in finding the right payment gateway for your e-commerce site. Remember, it’s essential to assess each gateway against the specific needs and goals of your business.

7. Choosing the Right Payment Gateway for Small Businesses and Startups

Navigating the world of e-commerce can be quite a journey, especially if you’re a small business or startup. Your needs are unique, and so is the perfect payment gateway for you. In this section, we’ll shed some light on what to look for and which platforms stand out for businesses at this stage.

Recognizing Your Needs

When you’re starting out, every penny counts. That’s why it’s essential to consider payment gateways that are cost-effective and don’t require huge monthly fees. You also want a service that’s easy to set up, flexible, and can scale with your business.

Comparing Suitable Options

Two great options that cater well to small businesses and startups are WooCommerce Payments and Shopify Payments.

- WooCommerce Payments is a no-hassle solution if you’re already using WooCommerce. There are no setup charges or monthly fees, and the standard rate is 2.9% + $0.30 per transaction for U.S.-issued cards.

- Shopify Payments, on the other hand, is directly integrated into the Shopify platform. The rates start at 2.9% + $0.30 per transaction for the Basic Shopify plan, but the percentage decreases with higher-tier plans.

Small businesses contribute to 44% of economic activity in the United States, underscoring the importance of choosing a payment gateway that caters to the specific needs of startups and small businesses.

Pricing for Small Businesses and Startups

Both WooCommerce Payments and Shopify Payments offer straightforward, pay-as-you-go pricing, making them suitable for small businesses and startups. They don’t require monthly fees, which is a big plus if you’re watching your budget. And the more your business grows, the more you’ll appreciate that these platforms don’t charge extra for features like fraud analysis and global support.

Essential Features

Small businesses and startups need to move fast, so look for features that help you do just that. Both WooCommerce Payments and Shopify Payments offer seamless integration with their respective platforms, making setup a breeze. They also support a variety of payment methods, including credit and debit cards, to cater to all your customers.

Keep in mind, starting small doesn’t mean thinking small. Choose a payment gateway that’s ready to grow with your business, supports your journey, and makes life easier for you and your customers.

Remember, the right payment gateway is out there for every business, small or large. It’s all about understanding your needs, doing your research, and making an informed decision. So, here’s to your e-commerce success!

8. Step-by-Step Guide to Integrating a Payment Gateway

Congratulations! You’ve chosen your ideal payment gateway, but what’s next? Now comes the critical part – integrating it into your e-commerce platform. While the specifics can vary slightly depending on the payment gateway and your platform, the general process is fairly similar across the board. Here’s a step-by-step guide to help you through the process:

Step 1: Set Up Your Merchant Account

Before you can start receiving payments, you need to set up a merchant account with your chosen payment gateway. This is typically a straightforward process. Simply go to the payment gateway’s website, click on ‘Sign Up’ or ‘Get Started,’ and follow the instructions to create your account.

Step 2: Gather the Required Information

To integrate the payment gateway, you’ll usually need your API key or similar credentials, which you can typically find in your account settings or dashboard. Keep this information handy as you’ll need it in the next step.

Step 3: Log into Your E-commerce Platform

Next, log into your e-commerce platform. Go to your site’s backend or dashboard. Look for a section or menu typically labeled as ‘Payment,’ ‘Checkout,’ ‘Payment Methods,’ or ‘Payment Gateways.’

Step 4: Select Your Payment Gateway

In the payment settings, there should be a list of available payment gateways. Select your chosen gateway. If it’s not listed, you may need to install it as a plugin or add-on.

Step 5: Enter Your Credentials

After selecting your payment gateway, you’ll need to enter the credentials you gathered in Step 2. This usually includes API keys, secret keys, or account IDs.

Step 6: Test the Integration

Before going live, you’ll want to run a few test transactions to ensure everything is working correctly. Most payment gateways provide a ‘sandbox’ or ‘test’ mode for this purpose. Make sure your test transactions process successfully, and the funds show up in the right place.

Step 7: Go Live

Once you’re confident everything is set up correctly and working smoothly, you can switch from ‘test’ or ‘sandbox’ mode to ‘live’ mode. Now your customers can make purchases through your chosen payment gateway.

Remember, this guide is just a general overview, and the exact process may vary slightly based on your specific e-commerce platform and payment gateway. If you run into any issues or need more detailed instructions, be sure to check out the support resources provided by your platform and payment gateway.

That’s it! With your payment gateway integrated, you’re now ready to accept payments and take your e-commerce business to the next level.

9. Step-by-Step Guide to Integrating Shopify Payments

Step 1: Log into Your Shopify Account

First, log into your Shopify account. Once you’re in, navigate to your admin panel.

Step 2: Go to the Payment Providers Page

From your Shopify admin, go to ‘Settings’ and then click ‘Payment providers’.

Step 3: Review the Shopify Payments Section

In the ‘Shopify Payments’ section, click ‘Choose third-party provider.’

Step 4: Select Shopify Payments

From the list of third-party providers, select ‘Shopify Payments.’

Step 5: Enter Your Account Details

You’ll now be prompted to enter your account details. This information is necessary for creating your merchant account. Be prepared to provide details about your store and your banking information.

Step 6: Set Up Your Card Statement

You’ll also need to specify how your store’s name will appear on your customers’ card statements.

Step 7: Configure Your Payment Capture

Next, decide whether you want to manually capture payments for orders or do it automatically. With automatic capture, payments will be taken as soon as an order is placed. With manual capture, you’ll have to process each payment within a certain timeframe.

Step 8: Activate Shopify Payments

Once you’ve completed the setup, simply click ‘Activate Shopify Payments.’ And voila, your payment gateway is set up!

Step 9: Test Your Setup

Before you start selling, make sure to test your payment gateway. You can do this by creating a test order.

10. Transitioning Between Payment Gateways

So, you’ve found a new payment gateway that suits your needs better. Great! But you might be worried about how to switch without causing any hiccups in your business operations. Fear not, I’m here to guide you through a smooth transition. Here are some steps to make the process seamless:

Step 1: Understand Your Needs and Limitations

Before you make the move, ensure you’ve thoroughly researched the new payment gateway. Consider the costs, features, compatibility with your e-commerce platform, and user experience. Understand what you stand to gain and any potential risks associated with the switch.

Step 2: Communicate with Your Customers

Your customers should never be left in the dark about any changes that may affect their shopping experience. Let them know well in advance about the transition, the reasons behind it, and how it will benefit them. Reassure them that their data will remain safe during the switch.

Step 3: Set Up the New Payment Gateway

Before you disable the old gateway, set up and thoroughly test the new one. This includes integrating it with your e-commerce platform, checking compatibility with your site design, and ensuring it functions as expected.

Step 4: Run Parallel Gateways

Consider running both the old and new payment gateways concurrently for a short period. This allows you to troubleshoot any issues with the new gateway without disrupting your business operations.

Step 5: Train Your Team

Make sure everyone involved in handling payments and customer inquiries is well-versed with the new system. This ensures any customer questions or issues can be handled efficiently.

Step 6: Monitor the New Gateway

Keep a close eye on the performance of the new gateway after launch. Look out for any dip in conversion rates, an increase in abandoned carts, or any unexpected errors or issues.

Step 7: Decommission the Old Gateway

Once you’re confident that the new payment gateway is functioning properly and you’re satisfied with its performance, you can begin the process of decommissioning the old one.

Step 8: Request Feedback

Finally, ask for customer feedback regarding their experience with the new system. This information can be valuable in making any necessary tweaks to improve the user experience.

Transitioning between payment gateways doesn’t have to be stressful. By taking the time to plan out your strategy, you can make the process seamless and beneficial to your business.

11. Troubleshooting Common Payment Gateway Issues

As wonderful as technology is, it isn’t always flawless. There might be times when you face certain hiccups with your payment gateway. But hey, don’t sweat! I’m here to help you identify and resolve some of the most common payment gateway issues.

Issue 1: Declined Transactions

This is a common problem that can be due to various reasons, like insufficient funds, incorrect card details, expired cards, or fraud prevention measures.

Solution: Encourage customers to double-check their card details, or try a different card. If the problem persists, it’s advisable for customers to contact their card issuer.

Issue 2: Gateway Timeout

Sometimes, a transaction might not go through due to a gateway timeout. This could be because the gateway’s server is down or experiencing issues.

Solution: If a timeout occurs, first check the gateway’s status on its official website or social media channels. If the issue is from their end, it will usually be resolved quickly. In the meantime, direct your customers to use an alternative payment method if available.

Issue 3: Integration Problems

Occasionally, there might be issues with how the payment gateway is integrated with your e-commerce platform, leading to transactions not processing correctly.

Solution: Check your integration settings and ensure that everything is correctly set up. Refer to the gateway’s integration documentation or reach out to their customer support for assistance.

Issue 4: Currency or Payment Method Not Supported

Your customers might be unable to pay if their currency or preferred payment method isn’t supported by your gateway.

Solution: Consider using a payment gateway that supports a wide range of currencies and payment methods. This ensures that you can cater to customers from different regions and with different payment preferences.

Issue 5: Slow Processing Time

If transactions are slow to process, customers might abandon their carts due to frustration.

Solution: Regularly monitor your site’s performance and transaction processing times. If your gateway consistently causes slowdowns, it might be time to consider switching to a more efficient gateway.

Remember, every problem has a solution. Stay patient, keep your customers informed, and work systematically to resolve any issues. Your business is built on trust, and transparency during these hiccups can only strengthen that bond.

12. Maximizing Your Payment Gateway for Business Growth

The right payment gateway is not just a tool for processing transactions; it can be a powerful ally in your business growth strategy. Leveraging your payment gateway effectively can help boost your sales, increase customer satisfaction, and help your e-commerce store thrive. Let’s explore how:

A. Offering Multiple Payment Options

Giving your customers a variety of payment options can significantly enhance their shopping experience. Catering to different preferences, from credit cards to digital wallets, can help to boost conversion rates and reduce cart abandonment.

B. Expanding Internationally

If global expansion is part of your growth strategy, choosing a payment gateway that supports multiple currencies and international payment methods is essential. This enables you to cater to a global customer base and facilitates smooth cross-border transactions.

C. Ensuring Seamless User Experience

A payment gateway that integrates well with your e-commerce platform and provides a seamless, easy-to-use interface can drastically improve customer experience. The less friction in the checkout process, the higher your conversion rates are likely to be.

D. Implementing Recurring Payments

If your business model includes subscriptions or any form of recurring payment, your payment gateway should support this. Automating recurring payments improves efficiency and enhances customer satisfaction by ensuring uninterrupted service.

E. Integrating with Analytics

Some payment gateways offer integration with analytics tools. This can provide valuable insights into customer behavior, popular products, and more, helping you make data-driven decisions to grow your business.

F. Prioritizing Security

Customers need to trust that their data is safe with you. Choosing a payment gateway known for its robust security features not only protects your business but also boosts customer confidence, which can lead to increased sales.

G. Providing Excellent Customer Support

Issues and queries are inevitable. Opting for a payment gateway with reliable customer support ensures that problems can be quickly resolved, maintaining a positive customer experience and minimizing disruption to your sales.

Your payment gateway is more than just a transaction facilitator. When leveraged correctly, it’s a potent tool that can aid in achieving your business goals and driving growth.

13. The Future of Payment Gateways

We’ve navigated through the maze of choosing and using the right payment gateway. But as a forward-thinking business owner, it’s vital to have an eye on what the future holds. Let’s explore some of the upcoming trends in payment gateway technology and how they can influence your decision-making.

A. Increased Use of Artificial Intelligence (AI)

AI is becoming an essential part of our daily lives, and the world of e-commerce is no exception. AI can enhance fraud detection and security, create personalized experiences, and automate customer support, making transactions even smoother.

What This Means For You: Prioritize payment gateways that are investing in AI and machine learning technologies. It could enhance your customer experience and secure your transactions even further.

B. Rise of Cryptocurrency Payments

Cryptocurrencies like Bitcoin are no longer a fringe phenomenon. More businesses are accepting cryptocurrencies, and more customers are using them to shop.

What This Means For You: While it’s still early days, considering a payment gateway that supports cryptocurrency transactions could future-proof your business and appeal to a tech-savvy demographic.

C. Mobile Wallets and Contactless Payments

Mobile wallets like Apple Pay, Google Pay, and contactless cards are seeing a surge in usage. The convenience, speed, and safety these methods offer make them increasingly popular among consumers.

What This Means For You: Ensure your payment gateway supports a wide range of mobile wallets and contactless payment options to cater to evolving customer preferences.

By 2025, it is estimated that contactless and mobile payments will reach $6 trillion globally, indicating the growing importance of adopting payment gateways that support these technologies.

D. Biometric Authentication

As technology advances, so too do security measures. Biometric authentication (fingerprints, facial recognition, etc.) can provide a higher level of security and create a seamless user experience.

What This Means For You: Look for payment gateways that have plans to implement or already support biometric authentication. It’s an added layer of security that customers will appreciate.

E. Personalized Payment Experiences

In the future, payment gateways will offer more personalized experiences, such as suggested payment methods based on past behavior or location-based offerings.

What This Means For You: Payment gateways that prioritize personalization can help improve the user experience and boost conversions.

By staying informed about these trends, you can ensure your e-commerce business remains competitive, meets customer expectations, and is prepared for the future.

Conclusion

Choosing the right payment gateway is crucial for your e-commerce site’s success. Consider your priorities, do thorough research, and prioritize scalability. Seek expert advice, test and optimize your chosen gateway, and remember to align it with your unique business needs. Make an informed decision and set the foundation for a thriving online business. Happy selling!